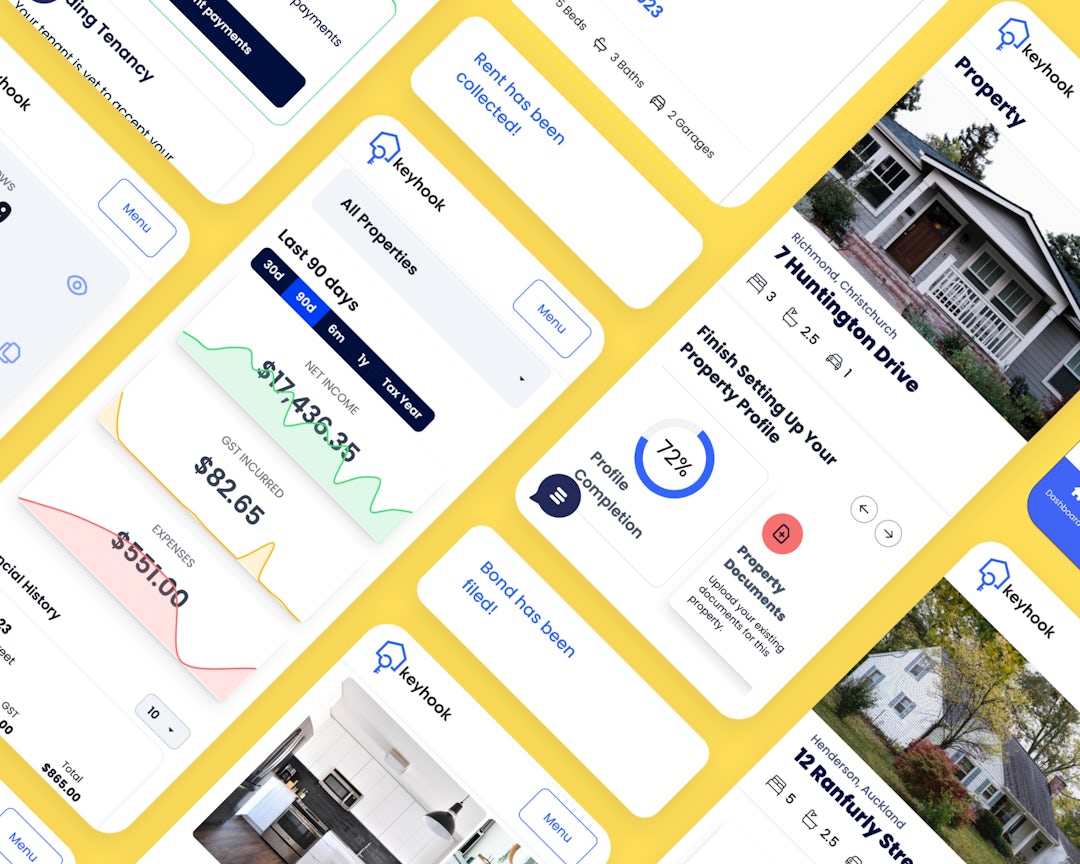

Rental propertiesMade simple.

Reduce costs, improve compliance and perform tasks quicker with Keyhook.

Manage your rental property like a professional with Keyhook

Welcome to the new way to manage your rental. Using smart-technology & an expert support team, Keyhook is the model disrupting the property management industry.

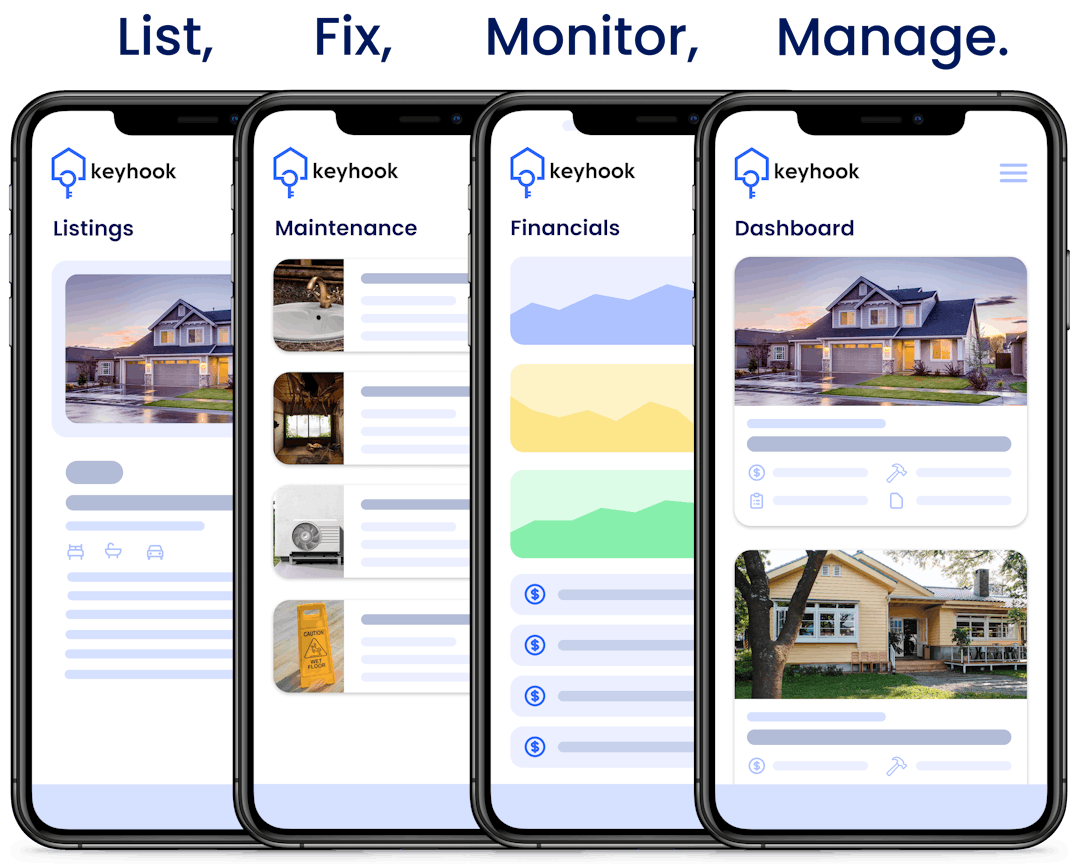

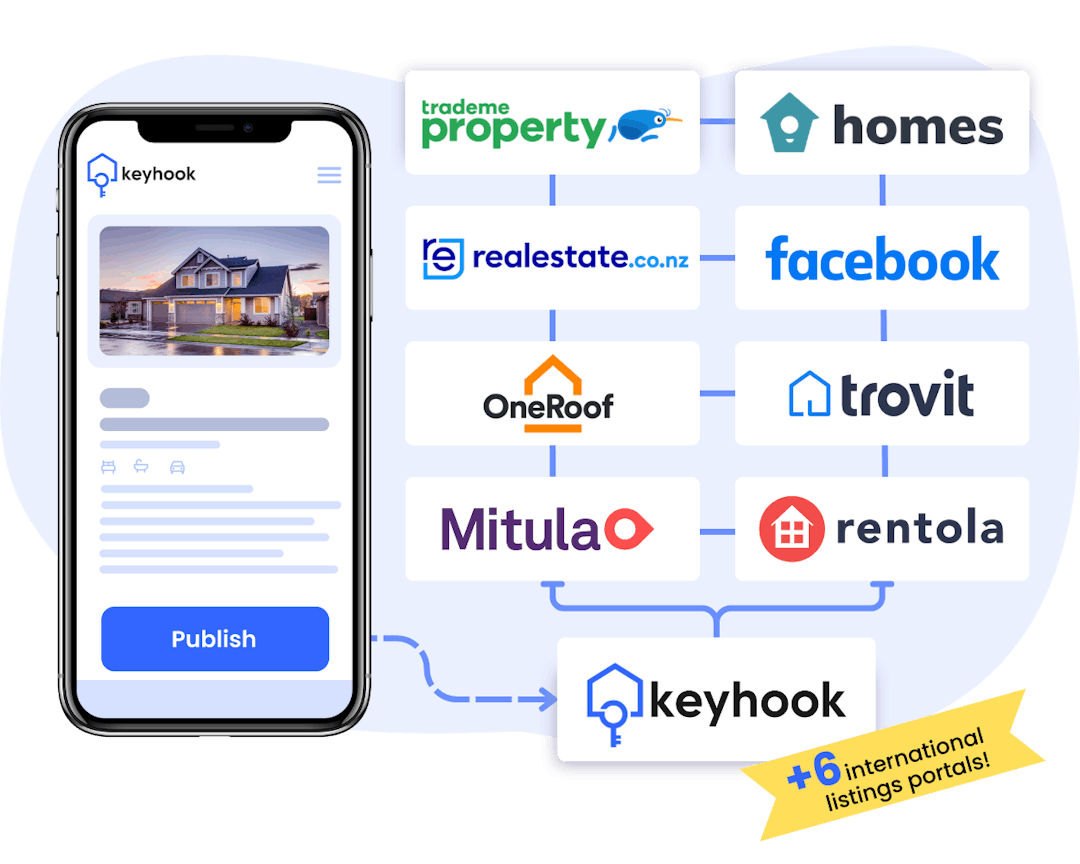

List Once,

List Everywhere

with Keyhook

Find the best tenants with NZ's most comprehensive listings platform.

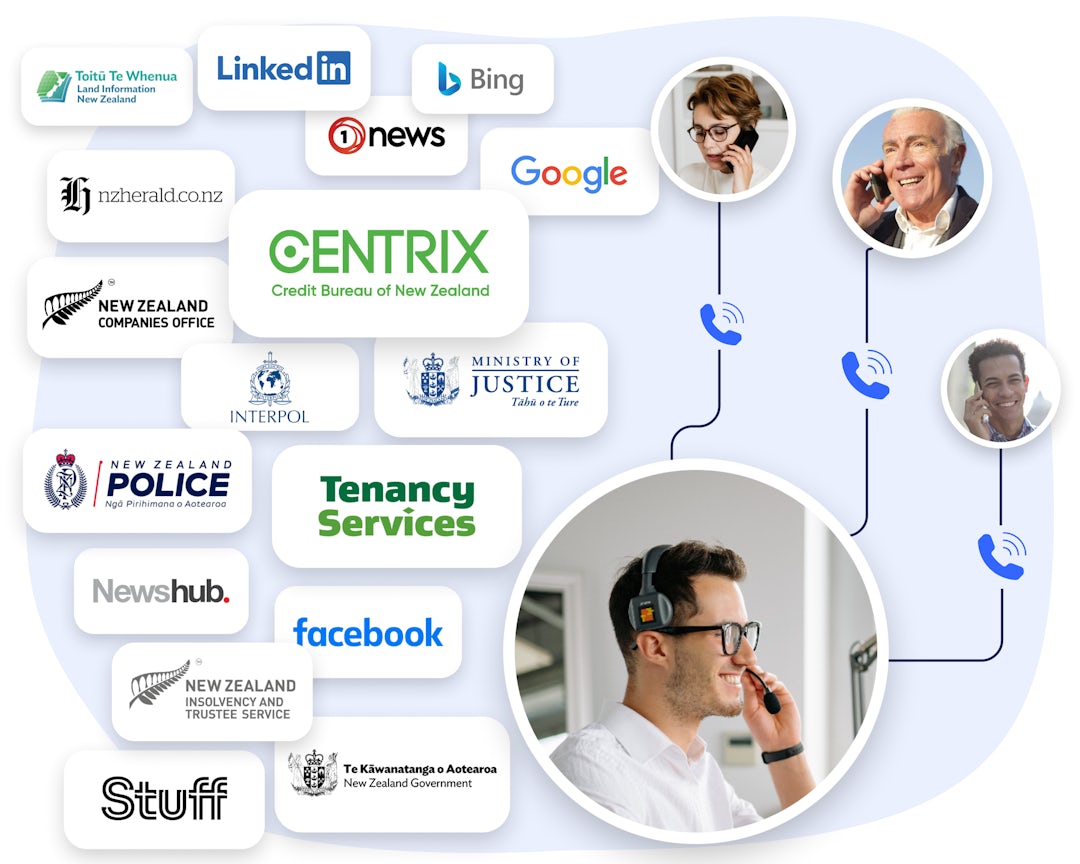

Comprehensive,

Cost-Effective

Tenant Checks

Stay compliant & make informed decisions. Conduct tenant checks in an instant.

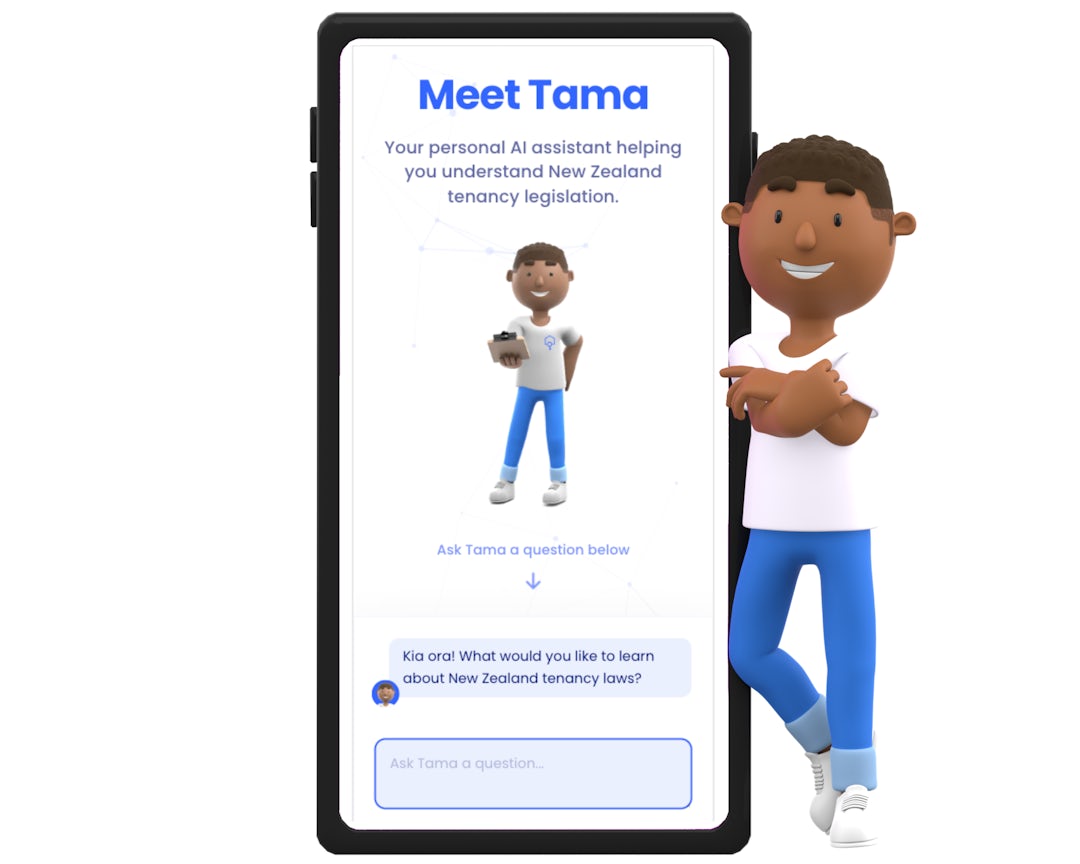

Free & Fast NZ Tenancy Law Guidance

Meet Tama: your personal AI-powered NZ tenancy expert.

Ask Tama a question and receive detailed, up-to-date guidance on anything tenancy related - completely free for all!

As seen on

Letting & inspection services handled by an agent.

Do you need someone to find you tenants? Can't make it to your quarterly inspection? We’ve got you sorted!

We have qualified agents across NZ that can do the ground work for you. Enquire below and one of the team will be in touch!

Join the thousands of happy Kiwis using Keyhook today

Manage your rental properties easily and efficiently - at any scale.

Whether you have one property or ten, Keyhook provides you with the tools you need for self-managing at every stage of your journey.